B2B

Explainable AI Insights for Global Trade

5

minute read

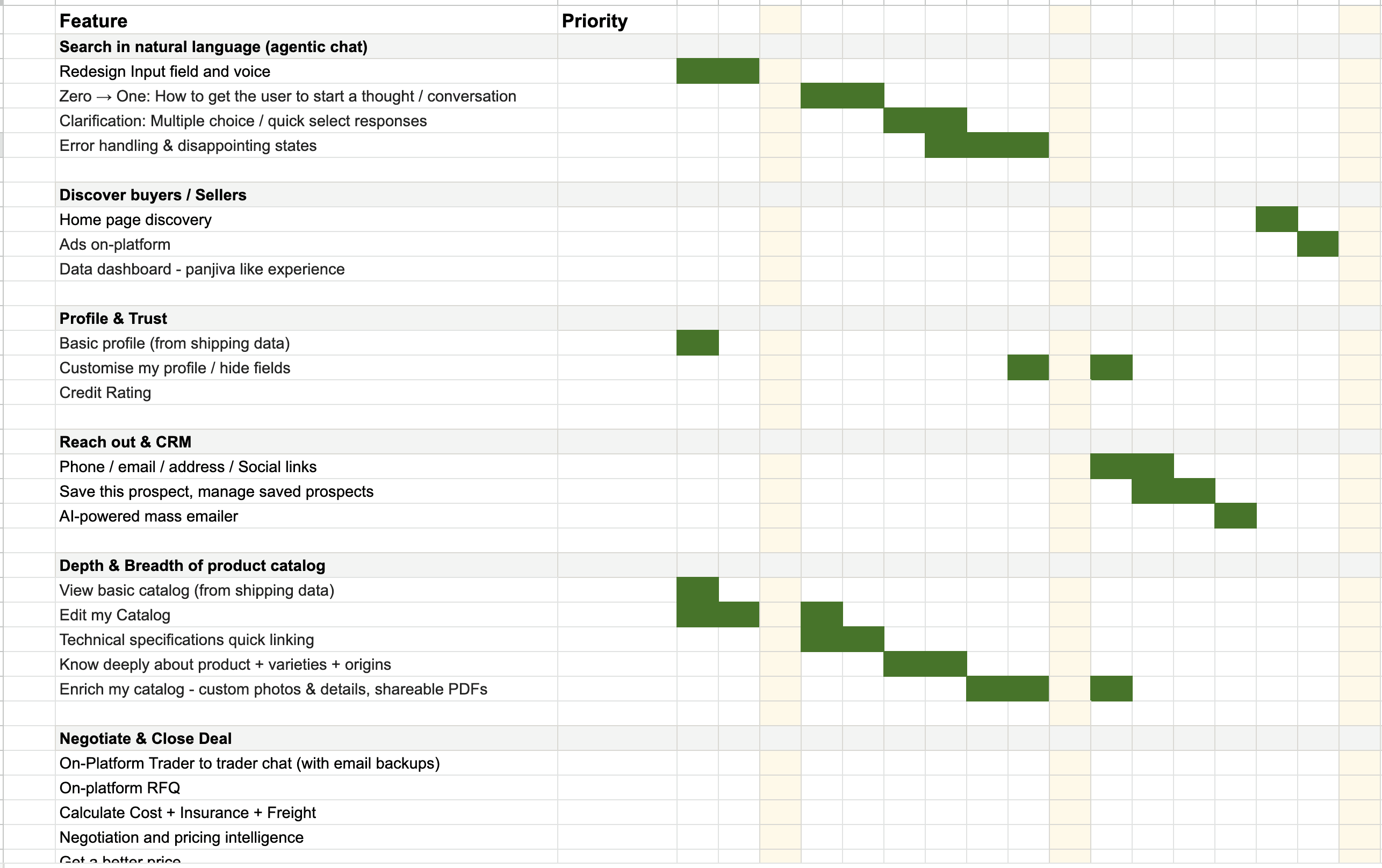

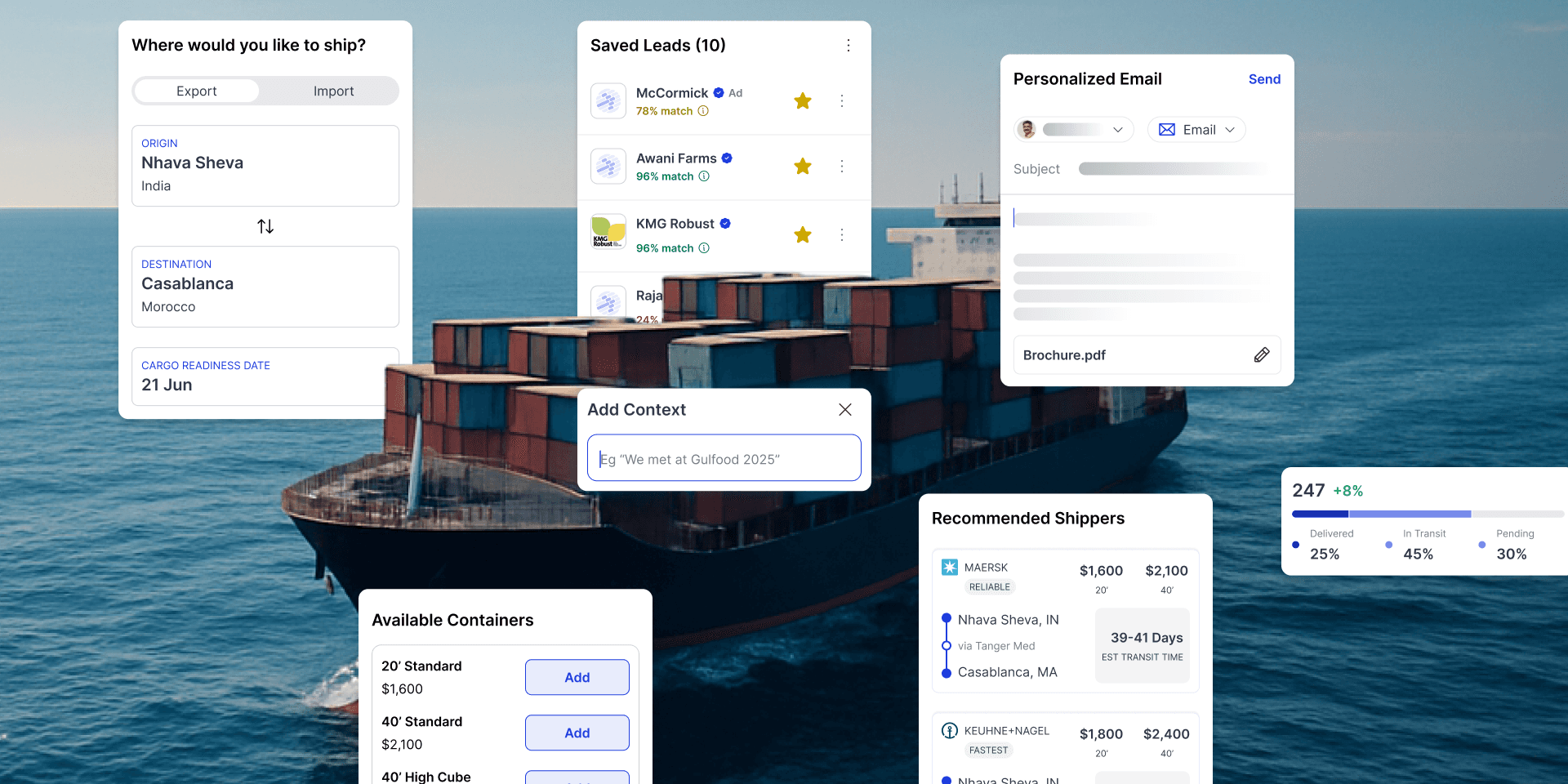

Tradyon was a chatbot POC that traders didn’t trust: open prompts, flaky answers, and no clear next step. Over 6 months, I reframed the product into a suite of AI power tools - Genie (explainable RAG insights), Outreach (lead-finder + CRM actions), and Distribution (importer workflows).

We replaced open-ended prompts with coverage-aware suggestions & deterministic workflows wired to real trade data. Result: fewer dead-ends and a faster Insight→Action path.

Role, Scope, Timeline

Role: Lead Product/UX Designer (IC + product strategy)

Scope: Product direction, IA, interaction patterns, design system tokens/states, user research, demo/ops enablement

Timeline: 6 months

Team: Founders, PM, 3 engineers, 1 junior designer; external data vendors

Signature wins (selected):

Trust & Usability: Templates + sources + confidence replace prompt roulette

Product Direction: Chatbot → suite with shared IA (Genie, Outreach, Distribution)

Ops Speed: Gen-art pipelines (Recraft) removed slow catalog shoots → zero-lead-time demo assets

Introduction

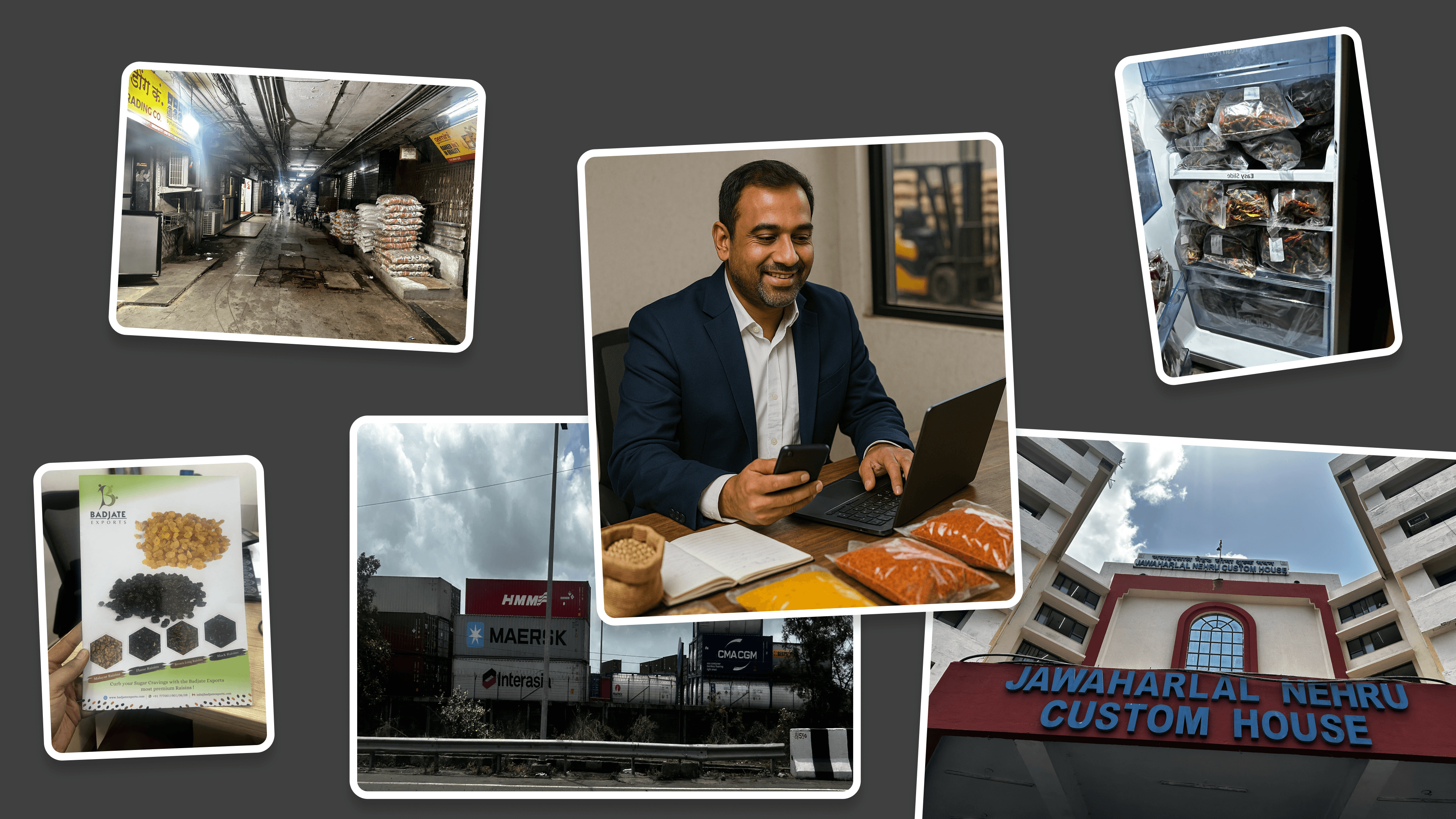

Imagine you run an agri-commodity business, focused on importing, processing, packing, and exporting dry spices. You want to find new buyers/sellers, quote better prices, and lower risks in order to grow your business. To do this, you look at what's going on in the world around you.

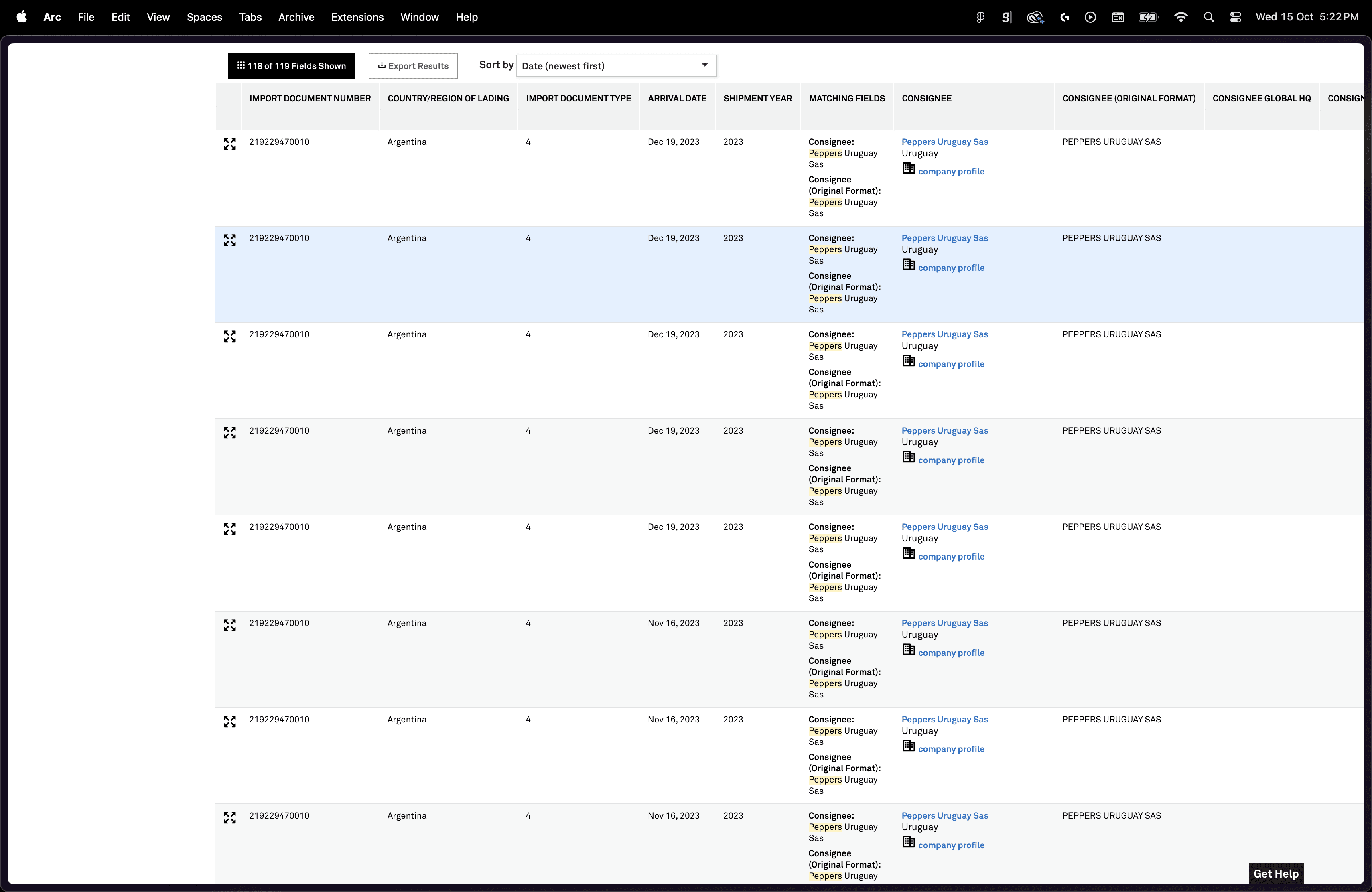

Global Trade Data

Every time a shipping container moves through a country, customs officials record crucial information: cargo, price, consignee, shipper, etc. This data collection depends heavily on local standard practices, and varies by country. Ultimately, aggregators like Panjiva, Volza, and Exim collect and sell this data to the end user.

Because you're a smart trader, you pay a hefty premium for this data. You also hire analysts to distill insights for your business: A list of potential buyers, a report on emerging pepper markets, or a growth strategy for the next quarter. You have to hire a team of salespeople to actually act on these insights: make cold calls, create email campaigns, manage prospects & customers.

The Traditional Businessperson

This workflow might be entirely inaccessible to a smaller trader. For him, price discovery happens by picking up the phone: He calls a friend in Brazil, then another in Vietnam, maybe a third in Indonesia. Crucially, he must maintain a personal relationship with each of them, ask about their wife and family, and only after exhausting all avenues of small talk can he get to business.

Doing all this manually costs money, and perhaps more importantly, time.

How Tradyon fits in

Tradyon saves time, money and effort by generating these insights and reports, leveraging prompt-to-SQL + RAG (Retrieval Augmented Generation) to ensure everything we recommend is grounded in the same high-quality data. An "everything assistant", the user can ask TradeGenie any question, just as they would with their staff.

Test Flight & Fieldwork

In a staunchly traditional domain that values personal relationships and reputation, it was crucial to test without risking negative perception around the brand and founders. To this end, we launched the pilot using a pseudonym and altered branding. We implemented feedback flows and primed testers to report bugs.

Users: Novice & experienced commodity traders, logistics stakeholders.

Field: Mumbai/Nhava Sheva port ride-alongs, remote calls (Egypt, Morocco, Brazil)

Research Learnings

The Data Reality

Acquiring data and the right to resell it is expensive. We started with a modest 3 months data for 2 commodities (Red Chilli, Black Pepper). Given the limited time-frame, patterns observed and insights drawn were weak. Users hit empty/noisy results and blamed the product, not the dataset.

Cold Start Problem

Unaware of the bot's capabilities and constraints, users struggled to ask meaningful questions. They asked anything; the system often failed silently or returned vague answers. Traders, especially new ones, didn’t know what to ask, what the AI could/couldn’t do, or why they should act.

Non-determinism in AI

LLMs by nature produce non-deterministic output. The bot would sometimes hallucinate and mix up commodities or data sources. Experienced traders often have ballpark estimates for prices and other data, so when something is off, the AI's blind confidence was frustrating.

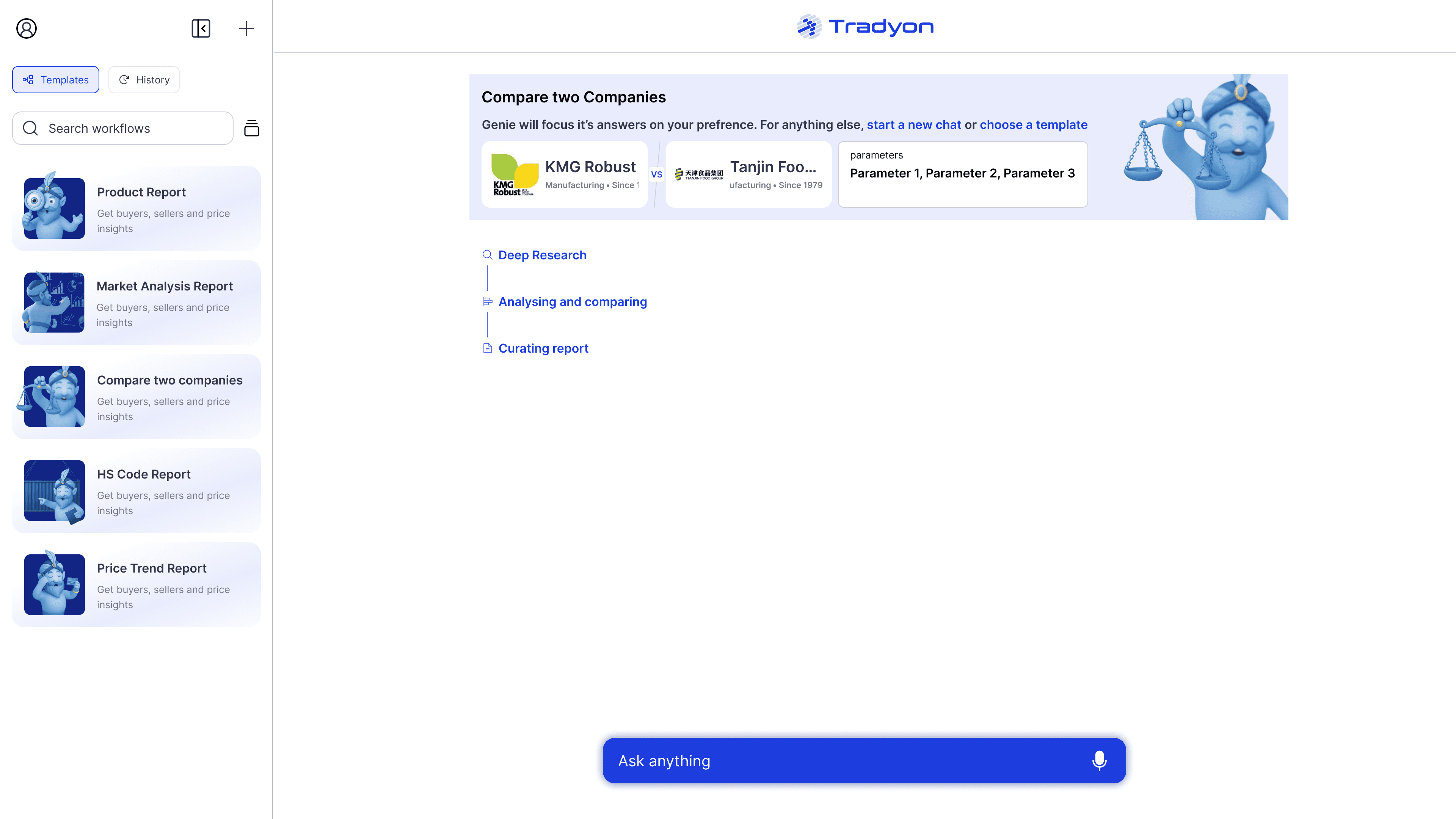

Design Improvements

We expanded data coverage to ~5 years across ~200 commodities. Trust and speed improved, but only because the UX told the truth about coverage from the start. We replaced open prompts with Suggestions & Templates: deterministic micro-flows over live trade data. This eliminated prompt paralysis, reduced nondeterminism, and created predictable results structures with explanations and next-step CTAs.

Design principles I set:

Trust before “magic” (show the why, admit limits).

In-workflow guidance (Insight → Action lives in one lane).

Progressive disclosure (Novice ↔ Pro modes without patronizing either).

When data is thin, templates degrade gracefully (neutral phrasing, explicit assumptions) or route to next best step (expand date range, adjacent HS codes, save a watchlist).

Speed as Strategy

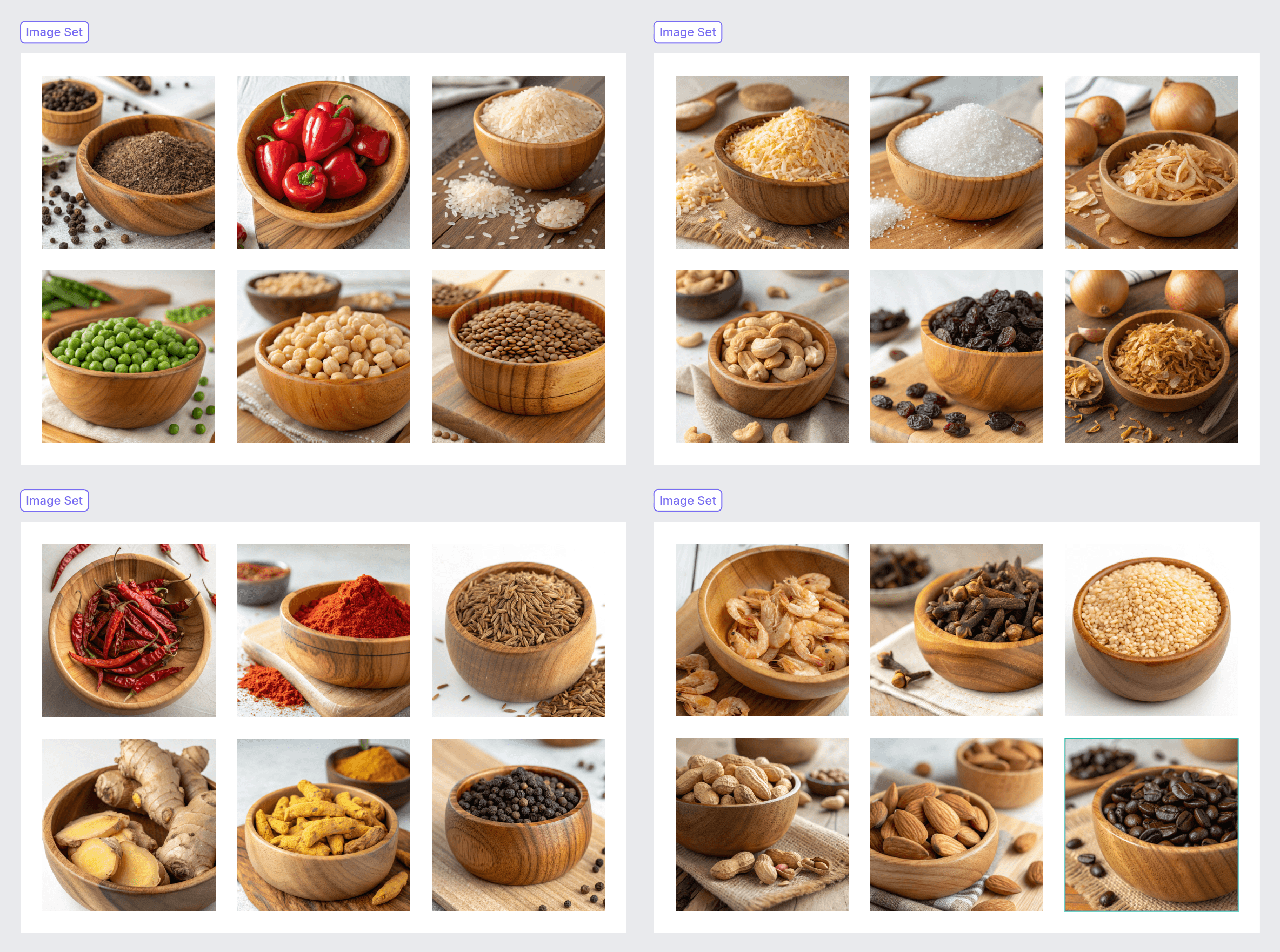

To deal with the increasing scale, I shipped design system tokens, state libraries, and extensive font and color guidelines, so patterns were reusable and decisions compounded. Ops sped up too: I replaced manual product shots with generative assets (Recraft.ai pipeline) to unblock 200+ commodities instantly.

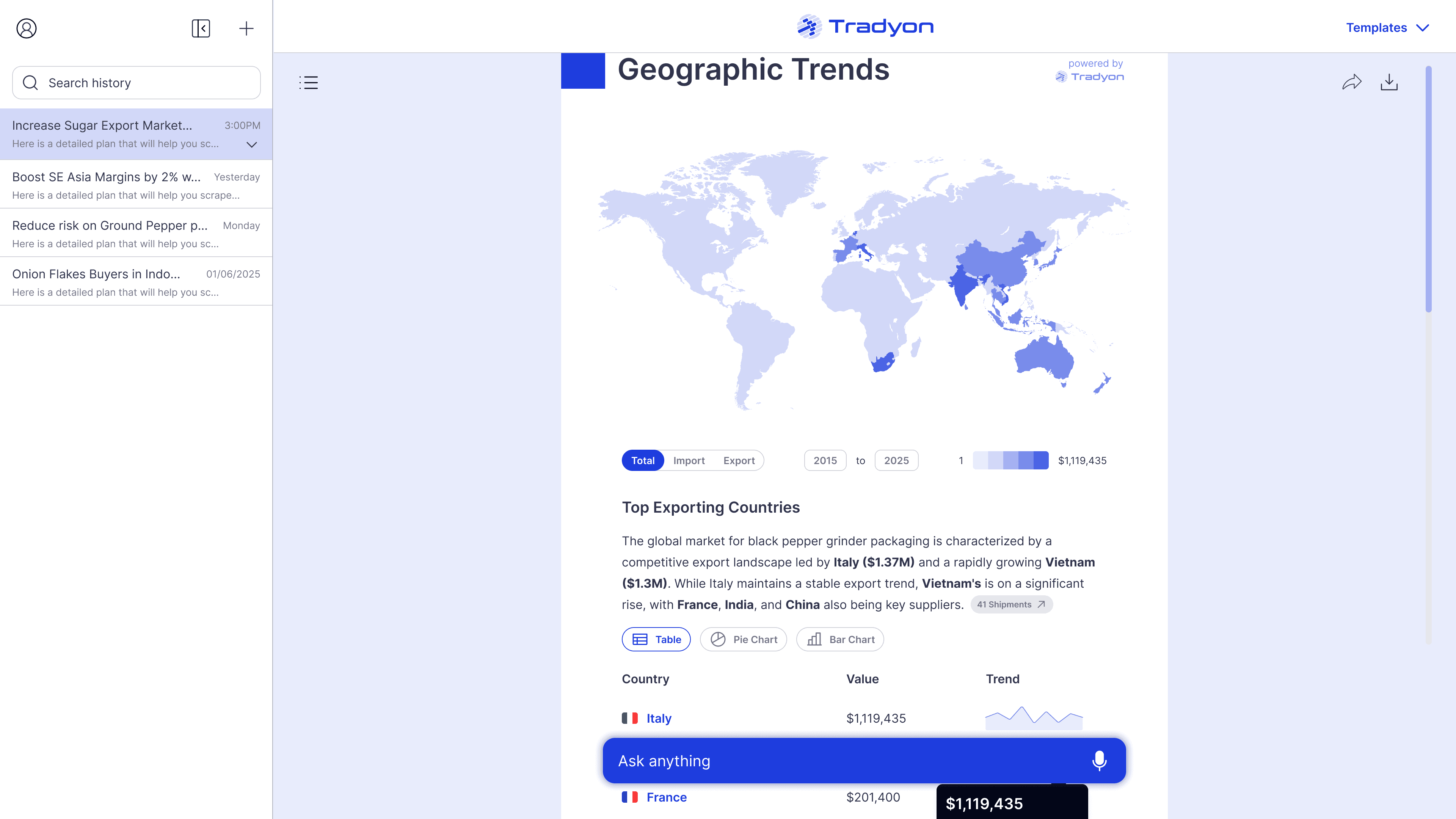

Evidence & Validation (In Flight)

We’re mid-validation; we chose honest proxies while hard metrics accumulate.

Dead-end/empty-state rate: ↓ on gated templates

Steps to “Insight→Outreach list”: ~8–10 → ~3–4

Time-to-insight: ↓; scales with coverage (visible via coverage badge)

Template availability per HS: ↑ (e.g., 3 → 8–10 reliable templates for top commodities)

Early qualitative signals: Smoother demos, fewer “model error” moments, clearer narrative from why → what next.

My Role Beyond Pixels

Product Direction: Reframed roadmap from “chatbot” to suite + data-readiness layer.

Interaction & Systems: Defined templates, source chips, confidence hints, right-rail Genie, deterministic flows; authored tokens and state libraries.

Team Practices: Set crit cadence, mentored juniors, wrote spec’d edge-cases to unblock engineering.

Ops Acceleration: Stood up gen-art pipelines (Recraft) to remove asset bottlenecks and speed sales enablement.

What Changed & What’s Next

Changed:

We now demo a suite narrative (not “talk to a bot”).

Traders see why (sources) and how sure (confidence) before acting.

Design & ops move faster via patterns, tokens, and instant visuals.

Next 90 days:

Confidence tuning + audit logs (enterprise readiness)

An Army of Agents (Agents

Tradyon as an Enabler (persona/goal-based templates, crowd-vetted)

Genie ↔ Distribution handshakes (e.g., auto-populate RFQs from insights)